In this article House Building Advance include 10 most important points taken from Swmay’s Handbook.

House Building Advance condition:-

1. House Building Advance eligibility:-

- All permanent Government employees.

- All other employees with at least 5 years of continuous service, provided they do not hold permanent appointment under a State Government and the sanctioning authority is satisfied about their likely retention in service till the house is built and mortgaged.

- Members of All India Service deputed for service under the Central Government/Company/Association/Body of individuals. whether incorporated or not, which is wholly or an International Organization and Autonomous Body not controlled by Government or Private Body.

- Employees of Union Territories and North-East Frontier Agency.

- Staff/Artistes of the All India Radio who fulfill the condition prescribed at (2) above and have been appointed in long-term contracts extending to the age as per extant rule.

- Central Government employees governed by the Payment of Wages Act, 1936.

- Central Government employees on deputation to another Department or on Foreign Service. Such cases to be processed by the Head of the Office of the Parent Department.

- Extant rules for eligibility conditions of Ex-servicemen nd of Central Government employees under suspension remains unchanged.

- In case where both the spouses are Central Government employees and are both eligible for grant of House Building Advance, the advance will be admissible to both of them jointly/separately.

2. House Building Advance Purposes –

- Construction a new house on the plot owned by the employee or the employee and the employee’s wife/ husband jointly with the clear title of the plot.

- Purchasing a plot and constructing a house thereon.

- Purchasing a plot under co-operative Scheme and constructing a house/flat thereon or acquiring a house through membership of Co-operative Group Housing Societies.

- Purchase/ construction of house under the self-finacing scheme of Delhi, Bangalore, U.P., Luchnow, etc.

- Outright purchase a new ready-build house/flat from Housing Boards, Development Authorities and other statutory or semi-Government bodies and from registered builders i.e., registered private builders, architects, house building societies, etc., but not from private individuals.

- Expansion of living accommodation of an existing house owned by the employee or jointly with spouse. The total cost of the existing structure (excluding cost of land) and the proposed additions should not exceed the prescribed cost ceiling under these rules.

- Repayment of loan or advance taken from a Government or HUDCO or private sources even if the construction has commenced, subject to certain conditions.

- Before grant of HBA, the Head of the Department –

- should satisfy himself that the home loans were taken by the Government employee entirely for the purpose of construction/purchase of new house/flat.

- should ensure that the HBA sanctioned is limited to the amount of loan still due to be repaid by the Government employee.

- HBA can be granted on the date the Government servant obtained loans from Banks and other financial institutions, irrespective of whether they applied for HBA before raising the loan.

- HBA for repayment of bank loan can be granted in one lumpsum and the Government employee shall produce the Utilization Certificate within one month from release of HBA.

- Employee to satisfy other provisions of HBA Rule.

Questions that are asked from google about House Building Advance eligibility:-

Q1. How many times HBA can be taken?

Ans. Only once in his/her lifetime.

Q2. What is the maximum limit of HBA that can be sanctioned?

Ans. 34 months’ basic pay.

3. House Building Advance Conditions. –

- The official should not have availed of any loan or advance for the purpose from any other Government source, Housing Board, other semi-Government or Local bodies, Development Authorities, etc. Where such loan has been availed of, HBA can be granted if the Government servant undertakes to repay the outstanding loan forthwith in one lumpsum.

- The official or spouse or minor child should not already own a house in the town/ urban agglomeration where the house is proposed to be constructed or acquired.

- If the official is a member of HUF, which owns a house at the same place, he may be granted advance restricted to 60% of the normal entitlement.

- The title to the land should be clear.

- Advance for ready-built house or flat is admissible for outright purchase only.

4. House Building Advance Cost ceiling. –

- Cost of the house to be built/ purchased (excluding the cost of plot)should not exceed 139 times of the basic pay of the employee subject to a maximum of rupee 1 crore (one crore) only.

- The cost ceiling may be relaxed up to 25% in individual cases based on merit by the Administrative Ministry concerned.

- Minimum cost-ceiling (लागत सीमा) need not be insisted.

- If both husband and wife are employed in Central/State Government, Public Undertakings, semi-Government Institutions or Local Bodies, the pay of both of them will be taken into consideration for calculating the cost ceiling.

- In the case of enlargement to existing accommodation, the total cost of the existing structure and the cost of enlargement should not exceed the limit in 4. Cost Ceiling above.

- If GPF withdrawal is also taken for house building, the total amount of GPF withdrawal and the House Building Advance should not exceed the cost-ceiling limit (4. Cost Ceiling above).

- If the advance is for constructing residential part of the building on a shop-cum-residential plot situated in a residential colony –

- the cost of land and the cost of superstructures of the proposed residential portion and shop(s) should not exceed the ceiling limit.

- the entire property including the shop(s) and the residential portion should be mortgaged (गिरवी).

- the entire building including the shop(s) should be insured against fire, lightning, floods, etc.

5. House Building Advance Amount of Advance. –

- Only one advance shall be sanctioned to the Government servant during his/her entire service.

- The maximum amount of advance shall be:

- 34 months’ basic pay subject to a maximum of rupees 25 lakhs only or cost of the house/flat, or the amount according to repaying capacity, whichever is the least for construction/ purpose of new house/ flat.

- for expansion of existing house, the amount of HBA will be limited to 34 months’ basic pay subject to maximum of rupees 10 lakhs only, or the cost of the expansion, or the amount according to repaying capacity, whichever is the least.

- the amount of the advance shall be restricted to 80% of true cost of the land and construction of house or cost of expansion of living accommodation in the case of construction in rural areas. This can be relaxed and 100% can be sanctioned if the head of the Department certifies that the concerned rural area falls within the periphery of town or city.

Questions that are asked from google about HBA cost ceiling condition:-

Q1. Is entire building including the shop(s) should be insured against fire, lightning, floods, etc.

Ans. Yes

Q2. What is the maximum limit of HBA that can be sanctioned ?

Ans. 34 months’ basic pay subject to a maximum of rupees 25 lakhs only or cost of the house/flat.

House Building Advance repayment instalment:-

- Enhancement of ceiling,

- Repaying capacity,

- Disbursement of advance.

- Time-limits for utilization of advance

- Surety in certain cases.

6. Enhancement of ceiling of HBA sanctioned on or after 1-1-2016 but before 9-11-2017. –

An enhancement of House Building Advance, if applied for, would be granted for an amount equivalent to the difference between the previously sanctioned amount and the new eligible amount determined on the basis of basic pay as per Seventh CPC, subject to complying following conditions.

(i) The employee should not have drawn the entire amount of HBA sanctioned under earlier orders and/ or where construction is not completed/full cost towards acquisition of house/flat is yet to be paid.

(ii) There will be no deviation from the approved plan of construction on the basis of which the original sanction of House Building Advance was accorded. The revised cost of the original plan can, however, be considered for determining the additional amount, subject to the prescribed maximum limits.

(iii) Supplementary Mortgage Deed, Personal Bond and Sureties will be drawn and executed at the expense of the loanee.

(iv) The actual entitlement will be restricted to the repaying capacity computed on the basis of the formula at 4. Cost ceiling above it should be ensured that the entire amount of advance with interest is recovered before retirement of the Government servant.

(v) The new rate of interest of 8.5% would be chargeable only on collective amount that would remain outstanding on grant of enhancement so granted. Thus, the amount of HBA that has already been repaid on old rates will not attract the fresh interest charges.

(vi) However, the existing limit of maximum admissible amount of 25 lakhs for expansion of existing house/ flat would remain unchanged. In other words, the sum total of previously sanctioned House Building Advance and the enhancement granted under these orders cannot exceed the aforesaid limits. In any case, not more than one enhancement is admissible to a Government employee.

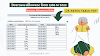

7. House Building Advance repayment instalment –

8. House Building Advance Disbursement of advance. –

(e) For purchase of plot and construction of house. –

(i) Single Storeyed House : After agreement in prescribed form is executed on production of surety bond, 40% of the advance or actual cost will be disbursed for purchase of plot. The balance amount will be disbursed in two equal instalments, first after the mortgage is executed and second on the consturction reaching plinth level.

0 Comments