GPF rules describe what is GPF and its condition, rules, 11 important points of General Provident Fund.

GPF rules :-

General Provident Fund (GPF) is a provident fund (PF) account in which the customer invests minimum of 6 per cent of emoluments or not more than his total emoluments for a certain period of time and avail the amount on maturity. GPF is available only for government Employees.

1. GPF Applicability –

The GPF Rules are applicable to those Central Government employees who have been appointed on or before 31-12-2003.

2. GPF Eligibility –

Temporary Government servants after continuous service of one year, re-employed pensioners and permanent Government servants shall subscribe to GPF compulsorily. Temporary Government servants may subscribe to GPF even before completion of one years’s service.

3. Amount of subscription

A sum (in whole rupees) as fixed by the subscriber, subject to a minimum of 6 per cent of emoluments and not more than his total emoluments.

4. Emoluments

means pay plus grade pay, leave salary and any remuneration of the nature of pay received in foreign service. Does not include DA.

Note: Whole or part of the bonus amount (ad hoc or productivity linked) may be deposited in the Provident Fund.

5. Minimum subscription.

Should be fixed at not less than 6% of his/her emoluments on the 31st March of the preceding year and in the case of new subscriber to the emoluments on the date of joining the Fund.

6. Enhancement/ Reduction.

Subscription may be increased twice and/or reduced once at any time during the year.

7. Suspension of subscription.

Subscription to the fund shall be stopped during suspension, and at the option of the Government servant during leave on half pay, leave without pay and dies non. Proportionate subscription to be recovered for the period of duty and any leave other than HPL/EOL.

8. GPF Recovery

to be stopped 3 months before retirement on superannuation.- No subscription should be recovered during the last three months of his service.

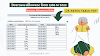

9. GPF Interest –

- 01-01-2018 to 30-09-2018 @7.6%

- 01-10-2018 to 30-06-2019 @8%

- 01-07-2019 to 31-03-2020 @7.9%

- 01-014-2020 to 30-09-2020 @7.1%

10. Nomination –

A subscriber can nominate one or more persons conferring the right to receive his GPF amount in the event of his death. If more than one person is nominated, the amount or share paable to each should be indicated clearly. A subscriber may at any time cancel a nomination by due notice and send a fresh nomination. A subscriber having a family can nominate only members of his family. Subscriber having no family can nominate any person/persons, including a Sompany/Association/Body of individuals/// a Charitable or other Turst or Fund. Subject to its validity, a nomination/notice of cancellation takes effect from the date of its validity, a nomnation/ notice of cancellation takes effect from the date of its reciept by the Accounts Officer.

Note.- A nomination submitted to the Head of Office is valid even if the subscriber dies before it reaches the Accounts Officer.

11. Family –

“Family” includes wife/wives except judicially separated wife, husband (unless expressly excluded), parents, a paternal grandparent when no parent is alive, children (including adopted children), minor brothers, unmarried sisters and deceased son’s window and chidren. A ward under the ‘Guardians and Wards Act, 1890″, who lives with the Government servant and to whom the Government servant has given through a special will the same status as that of a natural child, will also be treated as a member of the family.

Most Popular GPF rules related QnA that are asked from Google.

Q1. How much GPF is deducted from salary?

Ans. The customer invests minimum of 6 per cent of emoluments or not more than his total emoluments for a certain period of time

Q2. What is the purpose of GPF?

Ans. General Provident Fund allows individuals to deposit a sum of money periodically in their accounts until retirement.

Q3. What is rate of interest on GPF as on 2021 22?

Ans. 7.1%

Q4. Can GPF be withdrawn?

Ans. yes, A subscriber can withdraw the GPF amount on leaving government service or on retirement. He/she can partial withdrawals after 15 years of service or within 10 years of retirement.

0 Comments