CGHS general provisions Rules define and explain the ‘Demarcation of CGHS covered areas under CGHS Wellness Centre’ and ‘who can apply this scheme?’ It is first part of CGHS Rules.

1. General Provisions – Central Government Health Scheme

Demarcation of CGHS covered areas under CGHS Wellness Centre:-

(i) The coverage of CGHS shall be limited to the areas within 5 km (approx.) radius of the CGHS Wellness Centres, in all CGHS covered cities, wheresuch demarcations were not specified. The Additional Director, CGHS concerned city shall notify such areas covered under CGHS Wellness Centres.

(ii) The serving Central Government employees residing outside the CGHS covered areas shall be covered under CS (MA) Rules. However, in all CGHS covered cities, the serving Central Government employees residing within the Municipal limits of the city, shall be given a one-time choice to opt for CGHS [instead of CS (MA) Rules] from the nearest CGHS Wellness Centre.

Applicable to. –

- All employees paid from Civil Estimates (other than those employed in Railway services and those employed under Delhi Administration) having their headquarters and their family members in the cities mentioned above.

- Central Government pensioners (excluding Railways and Armed Forces pensioners) and those retiring with Contributory Provident Fund benefits and their families.

- Retired Divisional Accountants on the condition that the expenditure on cost-to-cost basis would be recouped from each State Government every year.

- Widows/ Child getting Family Pension, including minor brothers and sisters of such child.

- Delhi Police employees and their families.

- Civilians of the Defence Services at all stations (except Mumbai) where the scheme is in operations.

- PSU absorbees who had cmmuted 100% of their pension and have been restored 1/3 rd portion of their pension after 15 years.

- Central Government employees who got absorbed in Statutory Bodies/Autonomous Bodies and who are in receipt of Central Civil Pension are eligible to avail CGHS facility on their retirement.

- The employees of Indian Pharmacopoeia Commission and their family members.

- The employees of Supreme Court Legal Services Committee.

- Central Government employees who are on deemed deputation to Autonomous Bodies/STatutory Bodies of the Central Government and retiring while on such deemed deputation are eligible for CGHS facility, provided they are receiving Central Civil Pension and are not availing the medical facility provided by ABs/SBs after their retirement.

- From 1-8-2013, serving employees and pensioners of Department of Telecom residing or settled at Ahmedabad, Bhopal, Bhuaneshwar, Dehradun, Guwahati, Jaipur, Jammu, Jabalpur, Lucknow, Pune, Ranchi and Shillong and beneficiaries of Postal Dispensaries will be covered under CGHS, following the merger of 19 Postal Dispensaries with CGHS.

- Central Government employees on short-term deputation to SB/AB will be allowed to aail CGHS facilities during their tenure of deputation. They can opt for medical facilities provided by CGHS or by the organization.

- Defence Industrial Employees of Naval Dock Yard, Central Ordnance Depot and AFMSD can avail CGHS facilities in Mumbai at par with the Defence Industrail employees.

- Retired employees of Central Council for Research in Yoga and Naturopathy (CCRYN), Lalit Kala Akademi (LKA), Indira Gandhi National Centre for the ARts, Indian Council for Cultural Relations (ICCR) and Indian Red Cross Society, Central Social Welfare Board (CSWB), National Seeds Corporation Ltd., Gandhi Smriti and Darshan Samiti can avail CGHS facilities only in Delhi/ NCR, subject to certain conditions.

A. Accrual of CGHS benefits. –

The benefits of CGHS accrue from the date on which the Government servant applies for a CGHS card. CGHS is a compulsory scheme for all Central Government employees residing within the areas covered by CGHS dispensaries. As soon as a person joins Central Government service and intimates his residential address which is within a CGHS covered area, CGHS contribution at the appropriate rate should be recovered whether the CGHS card is issued or not. But in such cases, the offices concerned should ensure that the employee applies for a card and if he is not applying despite intimation, suitable action should be taken.

Note 1:- The Government servant should reside in the area covered by the Scheme. Pensioners can get their names registered with any of the dispensaries, whether they were residing in that city or not.

Note 2:- An employee covered by the Scheme whose spouse is employed in Defence or Railway SErvices, State Governemnt or Corportiations or Bodies financed partly or wholly by the Central Government or State Government, Local Bodies and Private Organizations which provide medical facilities can opt out ot the medical facilities provided by the employer of the spouse.

Note 3:- If an employee or a member of his family covered under CGHS falls ill at a place not covered under CGHS, treatment shall be admissible under CS(MA) Rules.

B. Family. – For definition, see Subject 4 under Section 16.

⇒ If both husband and wife contribute to the CGHS, eligible parents of both may avail the benefits.

⇒ Irrespective of age, the permanently disabled unmarried sons (boths physical and mental/ schizophrenia illness) who are financially dependent on CGHS beneficiary and residing with CGHS beneficiary and suffering from 40% or more of isabilities are eligible to avail CGHS facilities. After every five years, the CGHS beneficiary should furnsih a disability certificate issued by the appropriate authority to CGHS.

⇒ Sons above the age of 25 years, where the disability has occurred after attaining the age of 25 years can be considered as dependent for availing medical facilities under CGHS subject to fulfilment of conditions as mentioned in OM, 07-05-2018.

⇒ Permanently disabled unmarried brothers who are financially dependent on and residing with the princiopal CGHS CArdholder and suffering from 40% or more of disabilities are also eligivle to avail CGHS facilities subject to fulfilment of other conditions.

(i) With effect from 19-01-2012. – Minor children of widowed/ separated daughters who are residing with and dependent upon CGHS beneficiary are also eligible for medical facilities up to the age of 18 years (i.e.) the age of their becoming major.

(ii) Income limit for dependants with effect from 08-11-2016. – The income limit for the purpose of dependency for members of family (other than spouse) is 9,000 rupees per month plus amount of Dearness Relief stands for the amount drawn and not the amount due on the date of consideration. – OM, dated 08-11-2016.

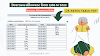

2. Contributions

(From 01-02-2017)

| Sr. No. | Corresponding levels in the Pay Matrix as per Seventh CPC | Contribution (Per month) |

| 1 | Level 1 to 5 | 250 |

| 2 | Level 6 | 450 |

| 3 | Level 7 to 11 | 650 |

| 4 | Level 12 and above | 1000 |

(a) For Pensioners/ Family Pensioners. – The rate of contribution will be with reference to the level of pay that he/she would have drawn in the post held by him/her (at the time of his/her retirement/death) had he/she continued to be in service now but for his/ her retirement/ death.

– OM, dated 09-01-2017 and 13-01-2017

Pensioners applying for CGHS Pensioner Card on annual/ lifetime basis after 31-01-2017 will have to pay as per the revised rate effective from 01-02-2017.

– OM, dated 09-02-2017.

When both husband and wife are Central Government servants covered by the Scheme, the contribution will be recovered from only one of them whose pay is higher. The recovery of contribution is effected through monthly salary of bills. It is recoverable during the period of duty, suspension and leave (other than EOL) not exceeding four months. In respect of leave exceeding four months, the employee has the option not to pay the contribution in which case the facilities under the scheme will not be available to him and his family members.

(b) Deduction of CGHS Contribution on change of Grade Pay by virtue of Promotion/ Grant of NFSG. – Any change in CGHS contribution, by virtue of promotion/ grant of NFSG, and change in grade pay retrospectively, the change of contribution is payable only from the date of issue of the order, and not from the date from which his pay is being effected.

– OM, dated 10-12-2015

3. Medical Advance

(a) For indoor treatment. – 90% Medical Advance of the approved CGHS package rates for all indoor treatments, irrespective of major or minor diseases, on receipt of a certificate from the treating Physician of Government/ recognized hospital.

(b) For outdoor treatment. – Advance is limited to 90% of the total estimated expenditure, if total estimate of expenditure including tests/ investigation is more than 10,000.

Advance to be released within 10 days of receipt of the request for advance by the Administrative Department/ Ministry/ Office.

– OM, dated 17-10-2016.

0 Comments