In this article, we tell What is LTC eligibility?, LTC for Railway employees and its scope. We will also clear the definition of ‘Family’ or in other ways – family definition in ltc 2022 and its rule.

LTC Eligibility :-

1. Any employee with one year of continuous service on the date of journey performed by him/his family is eligible.

Example – An official appointed on 31-12-2018 will be eligible for the two-year block 2020-21, but those appointed on or after 1-1-2021, will not be eligible for that block.

2. Period of unauthorized absence, declared so under FR 17-A, will be treated as break in service for calculating the continuous period of service, unless the break is condoned by the Competent Authority.

LTC to Railway employees. –

Railway employees (and employees whose spouses are Railway servants) are also allowed the facility of LTC in lieu of their free passes on the following conditions:

(a) No hometown LTC will be admissible to Railway employees. Only “All Inida” LTC will be granted once in a block of four years.

(b) All India LTC will be purely optional.

(c) For availing LTC, privilege passes admissible to them in the calendar year in which they intend to avail LTC will have to be surrendered.

(d) If the employee has already availed of a pass in any year, then LTC will not be allowed in that year.

(e) If both spouses are Railway servants, then both will surrender privilege passes.

The order shall be applicable to (i) Railway servants entitled to PPs; (ii) Other Government Department’s officials serving in Railways on deputation and entitled to PPs; (iii) Other officials serving in Railways and entitled to PPs and (iv) Officials of Audit Department (Railway) entitled to PPs. These orders would not be applicable to those who are undergoing minor penalty of stoppage of even a single PP at the time of application for availing AILTC.

The officials, who opt for AILTC facility, would be issued a “Privilege Pass Surrender Certificate” (PPSC) i.e. a prerequisite for availing AILTC. The “Pass Issuing Authority” (PIA) shall issue the PPSC.

Scope of LTC –

LTC will cover the Government servant and his family.

‘Family’ means. –

the Government servant’s wife or husband and two surviving unmarried children or stepchildren wholly dependent on the Government servant, irrespective of whether they are residing with the Government servant or not;

(ii) married daughters divorced, abandoned or separated from their husbands and widowed daughters and are residing with the Government servant and wholly dependent on the Government servant.

(iii) parents and/or stepparents (stepfather and stepmother) wholly dependent on the Government servant, whether residing with the Government servant or not;

(iv) unmarried minor brothers as well as unmarried, divorced, abandoned, separated from their husbands or widowed sisters residing with and wholly dependent on the Government servant, provided their parents are either not alive or are themselves wholly dependent on the Government servant.

Leave Travel Concession Rule 2022 (LTC salient point) is the second part of LCT Rule 2022. In the first part of LCT Rule 2022, describe about the eligibility of LTC.

Salient Points

(A) Home Town –

1. A Government servant may declare a home town which may be accepted by his Controlling Officer. The declaration made by the Government servant may be accepted and a detailed check may be applied only when he seeks a change. In exceptional circumstances, the Head of the Department may authorize a change in such declaration, only once during entire service.

2. When both the husband and wife are Central Government servants-

(a) they can declare separate Home towns independently;

(b) they can claim LTC for their respective families, viz., while the husband can claim for his parents/ minor brothers/ sisters, the wife can avail for her parents/ minor brothers/ sister;

(c) either of the parents can claim the concession for the children in a particular block;

(d) the husband/ wife who avails LTC as a member of the family of the spouse, cannot claim independently for SELF.

(B) Declaration of place of visit. –

When it is proposed to avail All India LTC, the Government servant shall declare the place of visit to his controlling officer. The declared place can be changed before commencement of the journey with the approval of the controlling officer but after commencement of the journey except under exceptional circumstances beyond the control of the Government servant. This relaxation may be made by the Administrative Ministry/ Department or the Head of the Department.

(C) LTC can be availed during any period of leave, including casual leave and special casual leave but not during weekend holidays without availing any leave.

(D) Class of journey. – The class to which a Government servant and his family will be entitled to is the class to which he belongs at the time the journeys are undertaken.

(E) Special cases. –

(i) Reimbursement of outward journey only. – A dependent son/ daughter getting employment or getting married after going to home town. Family performing journey to home town without any intention to return, provided the Government servant foregoes in writing the concession for the return journey, if performed at a later date.

(ii) Reimbursement of return journey only. – A newly married wife coming from home town to headquarters, a dependent son/ daughter returning with parents from home town where he/ she was prosecuting studies or living with grandparents, etc., a child previously below 5/12 years of age but completes 5/ 12 years at the time of return journey, a child legally adopted by Government servant while at home town.

(F) LTC can be combined with transfer/ tour.

(G) LTC during study leave. –

(i) For self. – Government servant can avail LTC from place of study to home town/ any place in India but reimbursement will bee restricted to fare admissible between headquarters and home town/ place of visit or actual expenditure, whichever is less.

(ii) For family members. – When family members are residing with the Government servant at the place of his study leave – same as for self.

When not residing at the place of study leave – reimbursement will be as under normal rules.

(H) LTC during suspension. – If an official is under suspension, he cannot avail LTC but his family can avail LTC.

(I) LTC during LPR – LTC to home town and any place in India will be allowed, provided the return journey is completed before the expiry of leave preparatory to retirement.

LTC to home town and LTC to any place in India are include in the Types of LTC. How many LTC are in a block & what is hometown LTC are also described in this article.

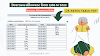

LTC to home town –

- Admissible to all employees irrespective of distance between between headquarters and his home town.

- Admissible once in a block of two calendar years. The present blocks are 2020-2021, 2022-2023 and so on.

- An employee whose family lives away from his headquarters can avail this concession for himself every year in lieu of all concessions.

- Government employees whose headquarters and home town are same are not eligible for home town LTC.

LTC to any place in India. –

- This concession is admissible in lieu of one of the two concessions to home town in a block of four years.

- The present block is 2018-2021.

- Officials availing LTC to home town for self alone every year are not entitled to LTC to any place in India.

Entitlements of a fresh recruit. –

Fresh recruits are allowed to travel to their home town along with their families on three occasions in a block of four years and to any place in India on the fourth occasion. This facility is available for the first two blocks of four years after joining the Government for the first time.

- The first two blocks of four years will apply with reference to the initial date of joining. The first two blocks of four years will be personal to them. On completion of eight years they will be treated at par with other regular employees.

- No carry-over of LTC is allowed for a fresh recuit. A fresh recruit whose home town and headquarters are same cannot avail LTC to home town.

MOst Popular Question and answer about LTC.

Q1. How many LTC are in a block?

Ans. In a block year, there will be three Hometown LTC or one time LTC to any place in India.

Q2. How many children are allowed in LTC?

Ans. Two

Q3. Can LTC be claimed for parents

Ans. Yes

Q4. Can both husband and wife claim LTC?

Ans. No, if both husband and wife are in

Block year and carry forward of LTC 2022

A Government servant and his family may avail LTC in different groups at different times during a block year of two or four years. The concession will be counted against the block of two or four years within which the outward journey commenced.

Can LTC be carried forward?

A Government servant who is unable to avail LTC within a particular block of two or four years can avail the same within the first year of the next block of two or four years.

Can the Home town LTC concession be carried forward?

In respect of officials entitled to Home town LTC, the concession can be carried forward to the first year of the next block only if the official is entitled to a carried forward LTC to Home town for that year.

Example. – Suppose an official is entitled to two concessions during the two blocks of 2018-19 and 2020-21.

- In respect of 2018-19, he can avail the concession to Home town before the grace period, i.e., by 31-12-2020. Then he is entitled to carry forward his LTC to anywhere in India to be availed before the grace period, i.e., by 31-12-2022.

- In the above case, suppose the official avails of LTC to Home town after 31-12-2020, this will be debited against the block 2020-21 and hence he will not be entitled to “anywhere in India LTC”. In this case, he will lose his entitlement for 2018-19 by not availing it before the grace period.

The Government servant and his family can visit either the same place or different places.

Most Important FAQ based on LTC Block year :-

Q1. Can we avail LTC in 2022?

Ans. Yes

Q2. What is the Carry forward year for LTC block year 2018-19.

Ans. 2020

Q3. What is the Carry forward year for LTC block year 2020-21

Ans. 2022.

Q4. Current LTC block year for central government employees is 2022-2025.

Ans. Three hometown LTC and One all india LTC can be availed after the completion of one year service by the government employe.

(a) Journey by Air/ Rail/ Steamer. –

Same as on Tour/ Transfer but the facility of Air Travel for LTC is admissible only form Level 9.

(b) LTC entitlement by Train. –

From 1-7-2017, travel by premium trains/ premium tatkal trains/ suvidha trains is permissible and the tatkal or premium charges shall also be reimbursable.

(c) LTC entitlement by road. –

Entitlements will be the same as in case of journeys undertaken on transfer. Reimbursement shall be admissible for journeys performed in a vehicle operated by the Government or any corporation in the public sector run by Central or State Government or a local body. In case of journey between places not connect by any public transport, the Government servant shall be reimbursed as per his entitlement for a maximum limit of 100 kms covered by a private/ personal transport based on a self certification.

(d) Journey by Air. – LTC air travel entitlement

- Government servants entitled to travel by air on LTC may travel by Air India only.

- Booking of tickets are to be done directly from the Airlines (at booking counters/ office/ website of Airlines) or form three authorized travel agents viz. Balmer and Lawrie and Company Ltd., Ashok Travels and Tours and IRCTC.

- In case of deviation, only those cases, where the Administrative Ministry/ Department will certify the fact that a bona fide mistake has occurred and undue hardship is being caused to the Government servant, shall be considered by this Department.

- Government servants not entitled to travel by air’ may travel by any airlines and claim reimbursement of train fare by the entitled class.

- Restriction of travel by Air India only need not be applied to non-entitled officers who travel by air and claim reimbursement of LTC by rail. Booking of tickets through authorized travel agents need not be insisted upon if non-entitled officers travel by air and claim reimbursement of LTC by rail.

- Effective from 9-9-2016, the dynamic fare component shall not be admissible where non-entitled Government servant travels by air and claim reimbursement of entitled class of Rajdhani/ Shatabdi/ Duronto trains. Reimbursement will be for fare after deducting the dynamic fare component.

Most Popular Question & Answer based on LTC entitlement

Q1. Air travel by non entitled officers on LTC by private airlines ?

- LTC for visiting NER, J&K and A&N in lieu of a Home Town LTC.

- Facility of air journey to non-entitled Government servants for visiting NER, J&K and A&N.

- Permission to undertake journey to J&K, NER and A&N by private airlines.

Terms and conditions:

- All eligible Government servants may avail LTC to visit any place in NER/ A&N/ J&K against the conversion of their one Home Town LTC in a four year block.

- Government servants, whose Home Town and Headquarters/ place of posting is the same, are not allowed the conversion.

- Fresh Recruits are allowed conversion of one of the three Home Town LTCs in a block of four years, applicable to them. One additional conversion of Home Town LTC to travel by air to any place in Union Territory of Jammu and Kashmir in each block of four years is allowed.

- Government servants entitled to travel by air may avail this concession from their Headquarters in their entitled class of air by any airlines subject to the maximum fare limit of LTC-80.

- Government servants not entitled to travel by air are allowed to travel by air in Economy class by any airlines subject to the maximum fare limit of LTC-80 in the following sectors:

- Between Kolkata/ Guwahati and any place in NER.

- Between Kolkata/ Chennai/ Visakhapatnam and Port Blair.

- Between Delhi/ Amritsar and any place in J&K.

Journey for theme non-entitled employees from their Headquarters up to Kolkata/ Guwahati/ Chennai/ Visakhapatnam/ Delhi/ Amritsar shall be undertaken as per their entitlement.

In case of direct air travel by a non-entitled Government employee on LTC from his Headquarters to the place of visit in NER/ J&K/ A&N, reimbursement shall be regulated to the entitled class rail fare from the Headquarters/ place of posting to the nearest relevant railhead (ie. Kolkata/ Guwahati/ Delhi/ Amritsar/ Chennai/ Visakhapatnam) based on the place visit in (NER/ J&K/ A&K) + LTC80 Economy class air fare from the same railhead to the place of visit, whichever is less.

6. Air travel by Government employees to NER, J&K and A&N as mentioned in Paras. 4 and 5 above is allowed whether they avail the concession against Anywhere in India LTC or in lieu of the Home Town LTC as permitted.

7. Air Tickets are to be purchased directly from the airlines (booking counters, website of airlines) or by utilizing the service of Authorized Travel Agent viz. ‘M/s. Balmer Lawrie & Company’, ‘M/s. Ashok Travels & Tours’ and ‘IRCTC’. Booking of tickets through other agencies is not permitted.

8. Unmarried Government servants, who are eligible for LTC to visit home town may avail the facility of converting one occasion of home town LTC in a block of four years to travel to NER, A&N or J&K under the special dispensation scheme.

LTC Advance latest Rules cover the rules of LTC Advance and its Claim rules & condition.

LTC Advance latest Rules:-

1. Up to 90% of the fare can be taken. Advance admissible for both outward and return journeys if the leave taken by the official or the anticipated absence of members of family does not exceed 90 days. Otherwise, advance may be drawn for the outward journey only.

The time-limit for drawal of LTC advance is 125 days (i.e. 4 months and 5 days) in case of journey by train.

Cases where LTC journey is proposed to be undertaken by other modes viz. air/sea/road, the time-limit for drawing LTC advance shall remain 65 days only.

2. The official should furnish Railway ticket numbers, PNR No., etc., to the Competent Authority within ten days of drawal of the advance.

3. Advance can be drawn separately for self and family.

Claim of LTC Advance Rules & condition:-

1. When advance is taken,

(a) the claim should be submitted within one month from the date of return journey. If not, outstanding advance will be recovered in one lumpsum and the claim will be treated as one where no advance is sanctioned. Further, penal interest at 2% over GPF interest on the entire advance is sanctioned. Further, penal interest at 2% over GPF interest on the entire advance from the date of drawal to the date of recovery will be charged.

(b) When claim submitted within stipulated time but unutilized portion of advance not refunded, interest is chargeable on that amount from the date of drawal to the date of recovery.

(c) When a part of the advance becomes excess drawal due to genuine reasons beyond the control of the Government servant, the Administrative Authority may, if satisfied, exempt charging of interest.

2. When no advance is taken, claim should be submitted within three months from the completion of return journey. Otherwise, the claim will be forfeited.

3. Relaxation.- Ministry/ Department with the concurrence of Financial Advisor can relax the time-limit subject to conditions.

Inside the article, we read about the rules of LTC reimbursement and LTC Procedural requirements for easy settlement of claims. LTC Reimbursement Rules also gives the answer of most popular Questions based on LTC Reimbursement that are asked from Google.

LTC Reimbursement Rules :-

(a) No daily allowance shall be admissible on LTC.

(b) Any incidental expenditure on local journeys shall not be admissible.

(c) Fares for journeys between duty station and home town, both ways, will be reimbursable; but telegram charges for reservation of onward/ return journeys, etc., are not reimbursable.

(d) By longer route in same/ different modes of conveyance. – When journey is performed by a longer route (not the cheapest) in two different classes of rail accommodation, the entitled class rate will be admissible for the corresponding proportion of the shortest. cheapest route and the lower class rate of the remaining mileage by such route. Where journey is performed by a longer route in different modes of transport, reimbursement will be made proportionately in respect of journey performed by rail and for the remaining shortest distance, as per entitlement by rail or the actual fare paid for journey by road, whichever is less. The claim has to be worked out on proportional basis for each/ actual mode of journey/ distance covered with reference to the distance by the shortest route.

(e) Actual rail fare as per the choice of rail tickets purchased by the Government servant for children aged between 5 years and under 12 years is reimbursable for LTC.

(f) Catering charges in respect of rail journey. – If the Government servant has to compulsorily avail the catering facility and the cost is included in the rail fare for Rajdhani/ Shatabdi/ Duronto trains, the fare charged shall be reimbursable in full as per entitlement/ eligibility.

Procedural requirements for easy settlement of claims

(i) Submit your application for leave before LTC journey is under taken.

(ii) Check your eligibility before applying for LTC. A retiring Government employee is eligible to avail LTC but the return journey should be completed before his date of retirement.

(iii) Journey should be undertaken in your entitled class only.

(iv) You can apply for an advance 65 days (125 days if journey is by train) before the proposed date of journey.

(v) If you draw an advance, you must produce the tickets within ten days of drawal of advance.

(vi) Government employees entitled to travel by air must travel by Air India only at LTC-80 fare or less. Government employees not entitled to travel by air may travel by any airlines but reimbursement will be restricted to the fare of the entitled class or actuals, whichever is less.

(vii) Booking of air tickets is to be done directly through airlines or through approved travel agencies only.

(viii) Submit your claim within three months after completion of return journey, if no advance is drawn and within one month after completion of journey, if advance is drawn. Belated claims can be processed by Ministries/ Departments with the concurrence of the Financial Advisor by relaxing the provisions.

Most popular Questions that are asked from Google.

Q1. What is LTC reimbursement?

A central government employee can purchase goods and services in lieu of the tax-exempt portion of the LTC.

Q2. Is LTC reimbursement taxable?

The amount received as LTA is tax-free up to a certain limit under Section 10(5) of the Income Tax Act, 1961. You can deduct LTC as an exemption from your taxable income.

0 Comments